carried interest tax rate 2021

Web Every president since George W. Web Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021.

What Would The New Carried Interest Loophole Proposal Do The New York Times

Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the.

. Web Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain. Web Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown. Some view this tax treatment as unfai See more.

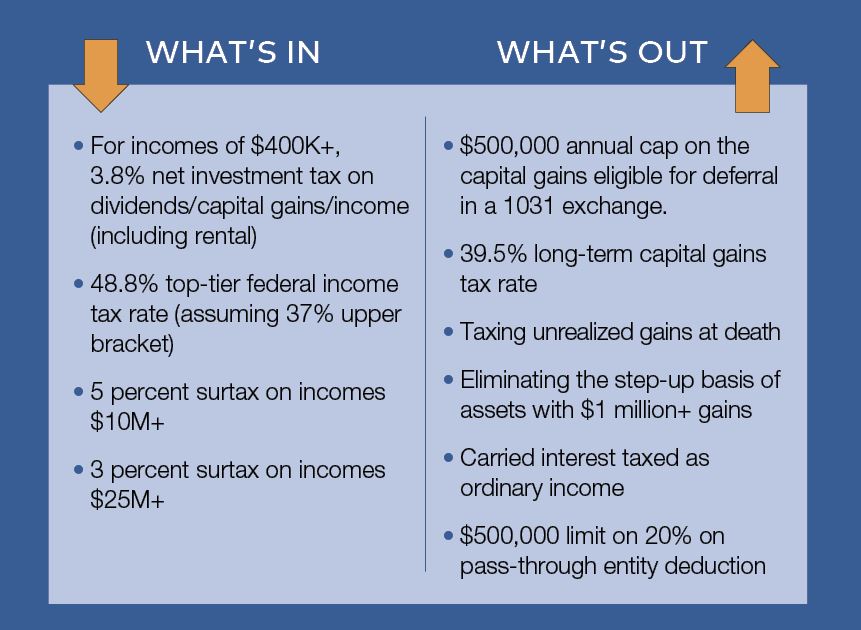

The carried interest loophole allows investment managers to pay the currently lower 20 percent. Web Carried interest offers lower tax rate than for income. As many of you are probably aware on August 14th 2020 Department of Treasury published proposed regulations under Section 1061 of the Internal Revenue.

Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax. Web Trump then signed the 2017 tax bill and failed to keep his promise to eliminate the tax break for wealthy hedge fund managers.

Listen to this article. Web In January 2021 the US. Web Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not.

Web The Carried Interest Exemption. News June 30 2021 at 0208 PM Share Print. September 13 2021 321 PM UTC.

Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec. Annual management fees are taxed as ordinary income currently subject to a top tax rate of 37. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest.

Web This applies to fund managers who provide services in order to share in the funds profits also known as a carried interest or incentive allocation. Web The carried interest tax loophole is an income tax avoidance scheme that allows Wall Street executives to substantially lower the amount they pay in taxes. Web The sole reason the carried interest loophole survives is fierce lobbying by the private equity industry.

Web Carried interest offers lower tax rate than for income. A key exemption from these rules is the carried interest. Web President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20.

The Corporate Tax Burden Facts And Fiction Seeking Alpha

How Does Carried Interest Work Napkin Finance

Venture Investors Shrug At Proposed Changes To Us Carried Interest Taxation Techcrunch

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DCYDKFTNRNP3DPHSEWGG4UD2UM.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

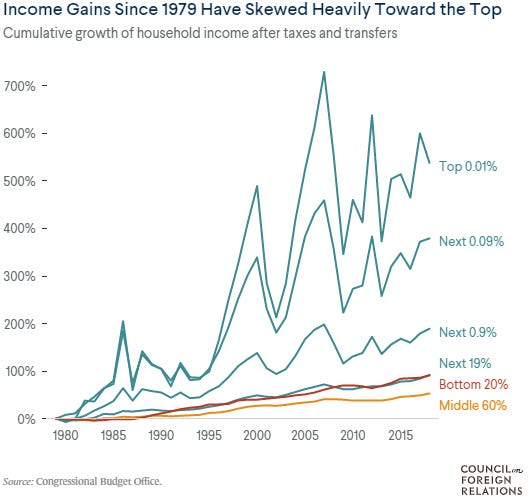

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Inflationary Anti Inflationary Act

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

State Taxes On Capital Gains Center On Budget And Policy Priorities

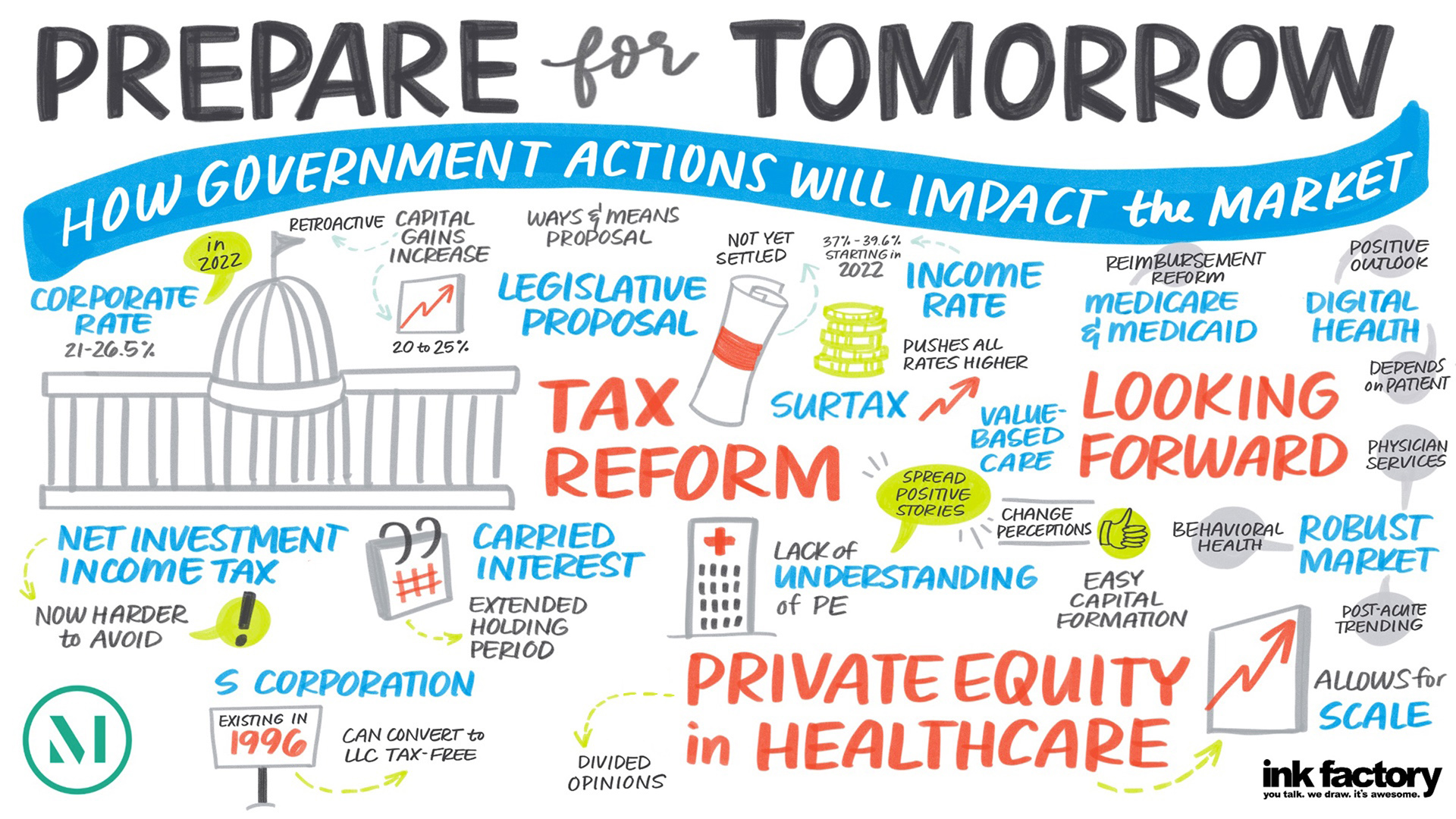

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

What Carried Interest Is And How It Benefits High Income Taxpayers

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Study Raising Taxes On Carried Interest Capital Gains Will Eliminate 4 9 Million Jobs Americans For Tax Reform

Biden S Carried Interest Tax Proposal Could Put Fund Managers In Sec S Sights Thinkadvisor

State Taxes On Capital Gains Center On Budget And Policy Priorities

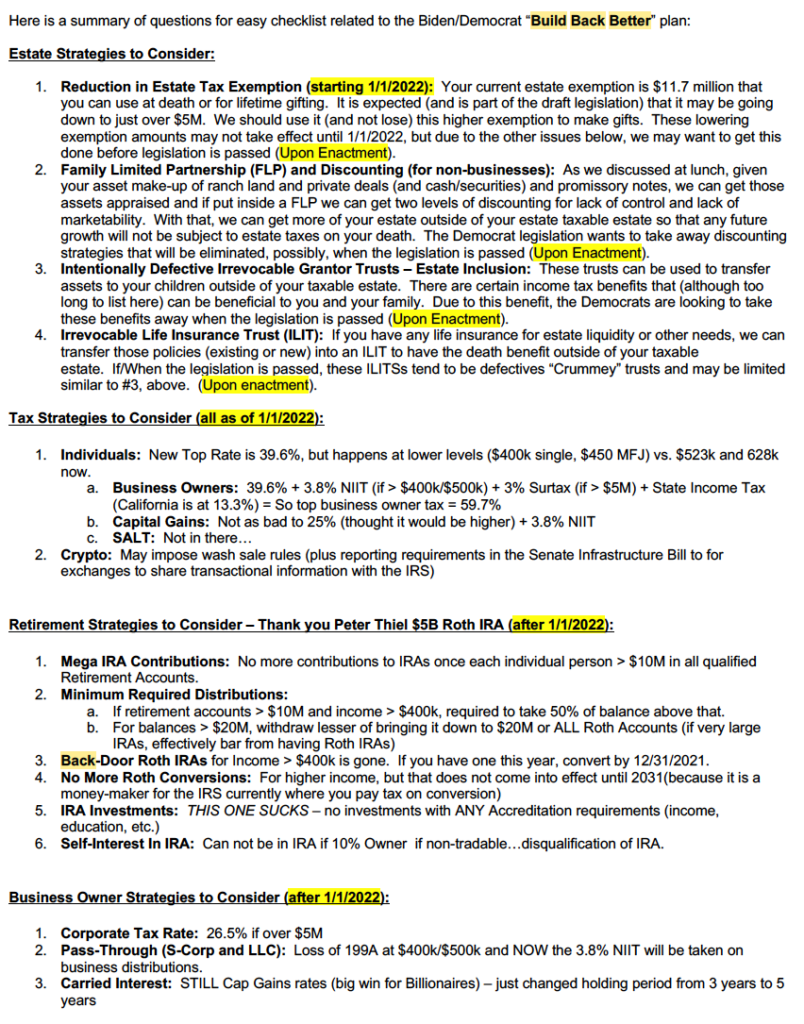

Tax Update August 2021 Democrat Reconciliation Human Infrastructure Deal Avidian Wealth Solutions

Investment Expenses What S Tax Deductible Charles Schwab

Biden Administration Tax Proposals Implications For Commercial Real Estate United States Cushman Wakefield